I. Introduction

Janngo is a new generation of Growth & Impact Fund focusing on Tech & Tech-enabled startups with a double bottom-line approach targeting both social & financial returns.

We back startups leveraging technology to accelerate and massify the access to:

- essential services, products and content for Africans ;

- market, capital and capacity for African SMEs ;

- employment, directly and indirectly, especially targeting women & youth

Our Impact Investment approach entails a full integration of Environmental, Social & Governance (ESG) issues in the investment decision-making process and is guided by a series of policies and processes. This includes an Impact & ESG Framework, as well as Investment Code on ESG and a proprietary Environmental, Social & Governance Management System (ESMS). Through effective management of ESG issues, we seek to not only manage risks and add value to business, but also be a positive influencer and contributor in the markets we serve and in the broader global community.

Janngo does not aim to only manage ESG risks or to seek ESG opportunities but aims to achieve both financial and ESG impact by focusing on business models with positive ESG impact and by being actively involved through its capacity building approach. To make sure we are making the right investment decisions, we implement data-driven processes with tailored performance indicators to measure ESG impact in addition to financial returns.

Janngo’s operations are classified as Category FI-B and have an Environmental and Social Management System (ESMS) which is proactive in E&S risk management.

II. Impact & ESG performance

To ensure we deliver strong Impact & ESG performance, we use an Impact Management wheel which aims at analyzing and challenging Impact & ESG aspects at every stage: pre-investment, post-investment and at/after exit.

Janngo’s Impact Management Wheel

A. Build an Impact oriented portfolio of startups

Step 1: Assess potential Impacts

A preliminary screening is performed by our team and aims at identifying the business model & sector of the prospective investee. Only investments that are not involved in businesses and sectors on Janngo’s exclusion list are considered. The exclusion list is defined in the Janngo’s Investment Code on ESG.

Then, we map every potential investment opportunity against Sustainable Development Goals. We have developed a proprietary SDG mapping tool which is inspired from the MetODD-SDG tool.

This tool has been developed by Cerise, a pioneer in the field of social performance management and has also been vetted and implemented by the French Development Agency (“AFD”) and other prominent Impact investors.

The sector of the prospective investee must materially impact at least one Sustainable Development Goal or more in order to go forward.

Step 2: Evaluate ESG risk and management

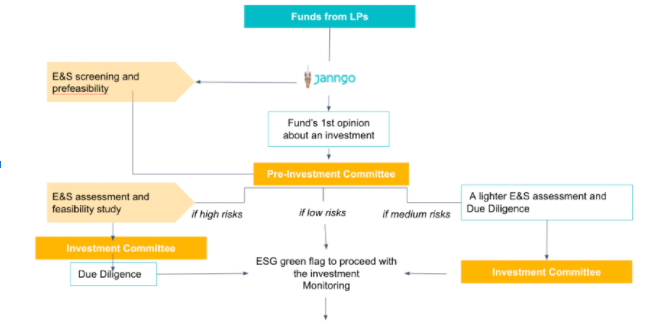

The Janngo team assigns a preliminary ESG risk category to the prospective investees based on their ESG risk profiles and the level of ESG management (high, medium or low). ESG risk rating categories are inspired from models and international standards used by IFC, CDC and FMO. The tool is described below in the section “ESG risk and management tool”.

This categorization enables us to determine the due diligence scope, monitoring, and actions required in the following phases.

Step 3: Conduct ESG Due Diligence

Janngo’s Due diligence includes an in-depth analysis of ESG-related matters as an integral part of the overall assessment and in close conjunction with:

- ESG Management system;

- Environmental performance, such as water and waste management, carbon footprint and energy efficiency, impact on biodiversity, etc;

- Social performance including, but not limited to, working conditions and human resources management, occupational health and safety, and Impact on local communities;

- Governance-related performance, such as business integrity and corporate governance framework. We have developed a proprietary Due Diligence checklist and questionnaire tool inspired from CDC best practices.

The aim is not to penalize prospective investee practices but rather to work with entrepreneurs to identify areas for improvement. When weaknesses and gaps are identified, the prospective investee is required to make a formal commitment to comply with recommendations and, when applicable, to comply with a timeline-based corrective action plan agreed prior to the investment.

These findings and provisions are then included in the legal documentation and integrated into the post-investment monitoring plan, with which the Janngo team will work on implementing ESG improvements.

B. Implement ESG action plans

The investment team and ESG Officer work with portfolio companies on concrete ESG action plans that generate economic value and are fully integrated into the company’s operations. Portfolio companies undertake to implement and monitor the ESG action plans. An investee’s contact person is appointed to oversee the process and is responsible for improving ESG performance.

The Janngo’s ESG Officer monitors the progress through periodic site visits, trainings, meetings and conference calls. Based on those interactions, the action plan can be updated, if necessary.

C. Assess Impact on local stakeholders

Janngo measures investee performance with an in-house tool based and inspired by international standards. Many indicators are currently collected and analyzed every year to assess our portfolio companies impact on local stakeholders such as staff, clients, suppliers & distributors, national value added, contribution to state revenues, GDP and/or exports.

D. Become an active Impact advocate

Janngo is involved in several initiatives and organizations and leading groups as an active advocate of Impact Investing including :

- as a Member of the Goalkeepers Community ;

- as a Member of the Impact Commission at France Invest ;

- as a Member of the Aspen Europe-Africa Council ;

- as a Member of the Africa Donor Collective ;

- as a Member of the Global Future Council of the New Economic Agenda of the World Economic Forum and as an active contributor to the World Economic Forum (WEF) communities & events such as the Annual Meeting in Davos;

To find out more about our work and various initiatives, visit the Janngo’s website: https://www.janngo.com/media/

III. ESG Management System framework & tools

Janngo has built a robust and proprietary ESG Management System which covers all critical ESG aspects at portfolio company level as well as at fund level in compliance with international standards including the leading Financial Institutions.

Janngo screens and categorizes every investee company according to their Environmental, Social & Governance risks and monitors the implementation of the Environmental & Social Management Plans (ESMPs), including the implementation of Corrective Action Plans to ensure full compliance with the host country laws and regulations.

The Impact Management Policy statement of Janngo’s ESMS is approved by each Senior Management of Janngo’s portfolio companies.

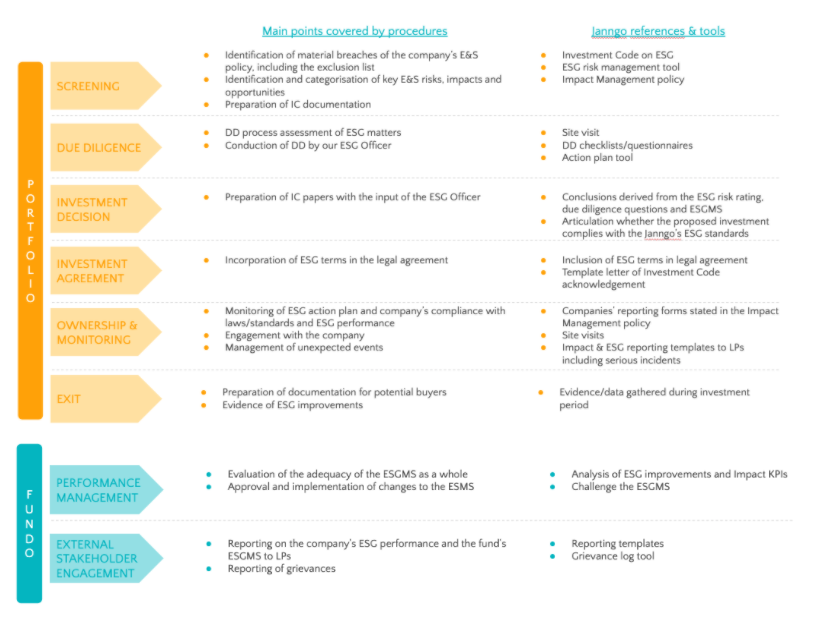

Janngo’s ESG Management System is fully embedded into its ESG framework described below:

The ESG risk and management tool is inspired by DFI ESG Management Toolkits and adapted to the unique specificities of its investees. Based on a number of characteristics, the tool enables to give six main outputs:

- E&S Risk Category

- E&S Management Score

- Corporate Governance Score

- Business Integrity Alert

- Business Integrity Score

- Potential E&S Risks and Issues

- E&S Risk Category

The E&S Risk category is determined by the sector and the type of investment. Investment type risks are associated with investments in existing operations, expansion of operations (brownfield) or a greenfield operation. Examples of these are risks relating to scarce resources, land acquisition, resettlement and indigenous people.

- E&S Management Score

The ESG Management Score is determined by 16 indicators. The score indicates the level of E&S management quality at the investee level.

- Corporate Governance Score

The Corporate Governance Score indicates the management performance level of a portfolio company with regards to Corporate Governance. It is based on 13 Corporate Governance indicators.

- Business Integrity Alert

The Business Integrity Alert is based on a combination of general, static risk factors of the investment, such as sector and the state in which the investment is located and investment-specific risk factors such as the involvement of a Politically Exposed Person (PEP), state ownership and privatization, or senior staff of the investee being on sanction lists.

- Business Integrity Score

The Business Integrity Score indicates the management performance level of a portfolio company with regards to Business Integrity.

- Potential E&S Risks and Issues

Three types of risks are considered to assess the E&S risk level : sectorial risks, state issues and state-specific sectoral issues.

The Environmental and Social aspects of the tool are based on the IFC Performance Standards. The Governance aspects of the tool focus on both Corporate Governance and Business Integrity.

IV. Implementing ESG Assessment Procedures

Janngo’s portfolio has a low-risk nature as its focus is 100% on Tech and Tech-enabled startups with minimal or no adverse environmental or social impact. Our ESG Assessment Procedures are described below:

V. ESG risk and management tools

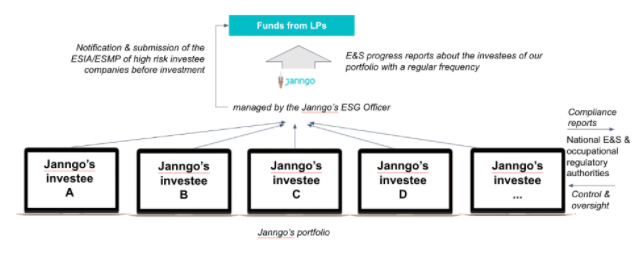

Janngo will report to the LPs on the ESG performance of each investee company in its portfolio.

Janngo will also notify and provide both the Environmental & Social Management Plans (ESMPs) and the ESG Impact Assessment (ESIA) for any high-risk investee company before investing. Janngo requires its investee companies to report on the management of ESG risks, according to their ESMPs.

These reports include key information about Operational Safeguards (OSs) such as Environmental and social assessment (OS1), Involuntary Resettlement: Land Acquisition, Population Displacement and Compensation (OS 2), Biodiversity and Ecosystem Services (OS 3), Pollution Prevention and Control, Greenhouse Gases, Hazardous Materials and Resource Efficiency (OS 4), Labour Conditions, Health and Safety (OS 5).